Just five years ago, most people would’ve laughed if you said India could rival China in electronics manufacturing. Times change fast. If you check your phone or your kid’s game console today, there’s a good chance it’s not just China behind that label anymore. India is making some serious moves—and it’s not hype. In the last couple of years, big names like Apple and Samsung have kicked off large-scale production there, bringing jobs and dollars, but also signaling to the world that India isn’t playing second fiddle.

Straight talk—choosing the best country for electronics manufacturing isn’t just about who has the lowest costs. You’ve got to look at policy support, tech skills, shipping, and those unpredictable headaches like supply chain hiccups (remember that global chip crunch?). Whether you’re running a growing startup or heading up an established brand, knowing what’s happening in each region is crucial.

Through real-life shifts in where things get built, and some surprising new rules and incentives, the electronics manufacturing map is getting redrawn. If you want a competitive edge, you need the facts—not nostalgia for what used to work a decade ago. So, which country is stepping up? Let’s dig into it and see why India’s story suddenly matters—a lot.

- The Old Guard: Why China Led for So Long

- How India Is Changing the Game

- Comparing Key Players: Costs, Talent, and Stability

- Tips for Picking a Manufacturing Base

The Old Guard: Why China Led for So Long

China didn’t just wake up as the world’s top spot for electronics manufacturing. It’s been building that reputation since the '90s. The country went all-in—massive factories, cheap labor, and a government ready to roll out red carpets (and cash incentives) for mega-corporations willing to set up shop.

Want the numbers? By 2023, China made almost 35% of the world’s electronics exports. Here’s what set them apart:

- Scale and Speed: Chinese cities like Shenzhen became electronics megacities, with whole neighborhoods turning into supply chains in action. You could design a gadget and get it made in days, not months.

- Labor Costs: Back in the early 2000s, labor was dirt cheap. Brands loved it. Even with gradual wage rises, costs stayed lower than in most Western countries.

- Infrastructure: Need ports? Highways? Raw materials? China’s logistics are next-level. Just-in-time production is part of daily life for manufacturers.

- Government Muscle: From tax breaks to building entire tech parks, the Chinese government made sure electronics giants didn’t feel red tape. If Apple wanted a 40,000-worker factory up and running, local officials made it happen—fast.

- Talent Pool: Engineering and technical schools churned out skilled workers ready to build anything from phones to solar panels.

This mix of speed, costs, support, and homegrown know-how is why brands like Apple, Samsung, and Dell banked on China year after year.

| Year | China's Share of Global Electronics Manufacturing (%) | China's Export Volume (USD billions) |

|---|---|---|

| 2015 | 31 | 670 |

| 2020 | 34 | 950 |

| 2023 | 35 | 1,100 |

But it wasn’t all smooth sailing. As factories got busier, wages climbed and concerns over quality, transparency, and international politics started popping up. Still, when people asked where to get electronics made at scale, China was usually the first answer—and often the only one people trusted to deliver on a tight deadline.

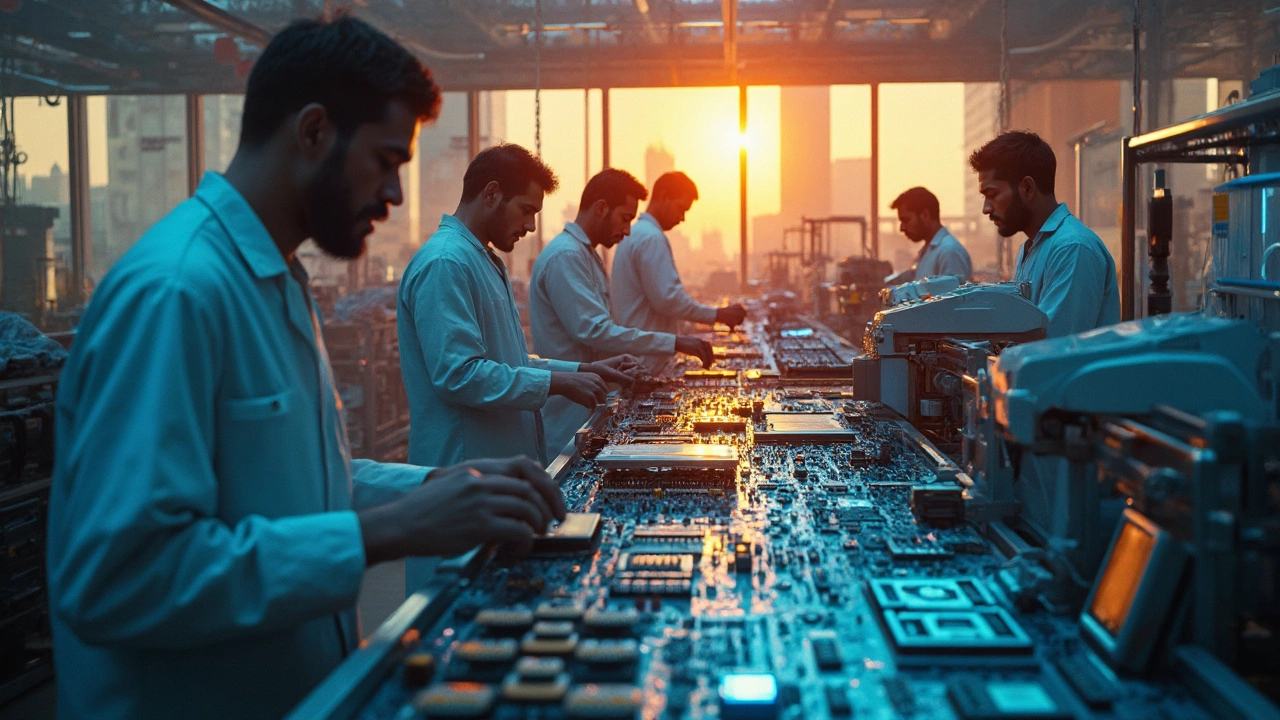

How India Is Changing the Game

Not so long ago, phones and TVs made in India sounded rare. Now, things look totally different. The government’s Production Linked Incentive (PLI) Scheme kicked in and, since 2020, it’s been like rocket fuel for the electronics sector. Companies get paid back for making goods locally, and this has really changed the vibe—major players like Apple, Xiaomi, and Samsung have all expanded or set up huge manufacturing bases here. It’s not just about assembling either; India is moving deep into making parts and chips locally.

Factories are popping up in places like Tamil Nadu, Uttar Pradesh, and Karnataka, known for having good roads, ports, and easy access to airports. Labor costs are famously low, and the country’s got a big, young workforce that’s quickly learning the ropes. Over one million new direct jobs in electronics manufacturing have appeared in the last five years, and exports nearly doubled between 2021 and 2024. Families like mine see this up close—more friends are finding work related to tech assembly and logistics.

But it’s not just about jobs and low wages. India’s tech universities and engineering programs churn out hundreds of thousands of fresh grads each year. That means more skilled engineers at lower salaries compared to rivals. You need a quick view? Check out this table:

| Factor | India | China | Vietnam |

|---|---|---|---|

| Avg. manufacturing wage (USD/hour) | 1.20 | 6.50 | 3.00 |

| Electronics exports 2024 (USD) | 25B | 850B | 120B |

| Engineering graduates/year | ~900,000 | ~1.2M | ~100,000 |

| Govt. incentives | High (PLI, tax breaks) | Medium | Low |

Here’s something wild: India’s mobile phone production jumped from just 60 million units in 2014 to over 310 million in 2023. A part of the reason is that electronics manufacturing in India isn’t only about cheap labor anymore—it’s about scale, policy backing, and a supply chain that’s improving every year. Logistics have gotten better with projects like the Delhi-Mumbai Industrial Corridor, which speeds up parts and finished product movement.

If you’re considering manufacturing in India, don’t forget the extra perks: customs single windows make imports simpler, and several states offer extra land or electricity subsidies if you set up shop in their industrial parks. Plus, Indian bureaucracy might not have the best reputation, but digitization (stuff like simplified GST and e-invoicing) has made things smoother over the last couple of years.

Comparing Key Players: Costs, Talent, and Stability

If you line up the big names in electronics manufacturing—China, Vietnam, India, and a few wild cards like Mexico—each one has its own strengths and pitfalls. It’s not just who can build a smartphone the cheapest, but who can keep the business running when things get bumpy.

Let’s start with costs. China used to be untouchable for low wages, but labor prices have jumped over 10% most years since 2018. Vietnam has been catching attention thanks to even lower wages and tax breaks. But when you look at the latest numbers, India now offers the lowest average labor costs out of the big three. Plus, a lot of states in India are giving companies extra tax incentives if they build locally or hire more workers.

Now, about talent. China has huge, well-trained factory teams—no doubt. Vietnam is still building up its workforce, and sometimes it’s harder to find engineers or managers who know the tech inside out. Here’s where India is really making progress. It churns out over 1.5 million engineering grads every year, and big global brands say they’re actually finding the deep skillsets they need, from design to production floor leads. The talent pool keeps getting wider as companies set up and train even more locals.

Stability is where things get tricky. Everyone saw what trade wars, COVID, and port blockages did to schedules and budgets. China keeps things moving well, but international pressure and shifting politics make companies a bit twitchy about depending so heavily on just one country. Vietnam saw some shipping bottlenecks last year, but it’s fixing port capacity. India has had inconsistent power and infrastructure in the past, but since the 'Make in India' push, we’ve seen real investment in highways, freight trains, and better electricity supply. Major companies say their supply chains are now less likely to hit those painful delays—especially if they plan right.

- China: Established, strong talent, rising costs, and some geopolitical risk.

- Vietnam: Cheap labor, improving ports, but workforce still growing.

- India: Cheapest labor in the group, huge pool of skilled workers, and infrastructure getting smarter every year.

If you’re deciding where to invest or shift production, don’t just chase the lowest price tag. What keeps your supply (and your sanity) stable is a mix of costs, talent, and the system running smoothly even when there’s chaos elsewhere. India is now in the sweet spot for a lot of growing brands moving into the next decade.

Tips for Picking a Manufacturing Base

If you’re thinking about setting up shop or shifting production, you don’t want to rely on guesswork. Every wrong move can cost a fortune—and waste years. Here’s what actually matters when picking where to manufacture electronics.

- Government incentives and policies: India, for example, is drawing attention with its Production Linked Incentive (PLI) scheme, offering cash rewards and tax breaks for electronics manufacturers. Vietnam has lowered corporate taxes for tech firms, while Mexico promotes free trade zones. Always check what local governments are offering—these incentives can turn a good deal into a great one.

- Labor force quality and cost: You need skilled workers who can handle modern electronics assembly. In India, a growing pool of engineering grads keeps labor costs low but talent quality high. By 2023, the average monthly wage in Indian manufacturing was under $300, compared to China’s $650, according to Statista.

- Supply chain and logistics: Don’t overlook stuff like port access, shipping lanes, and the reliability of local transport. India’s rollout of dedicated freight corridors cut logistics delays by over 40%. China’s ports are still faster, but the gap’s closing.

- Political and economic stability: You can’t build long-term plans on shaky ground. India, despite a few hiccups, is largely predictable. Places with sudden policy shifts or security problems often see surprise disruptions or plant shutdowns.

- Access to materials: If your parts come from somewhere far, shipping eats into margins. India’s electronics clusters in Tamil Nadu and Noida make sourcing parts and components much simpler now than a decade ago.

Compare the heavyweights at a glance—the numbers don’t lie:

| Country | Avg. Labor Cost (USD/month) | Major Incentives | Lead Time to US/EU (days) | Ease of Doing Business (2023 World Bank Rank) |

|---|---|---|---|---|

| India | 290 | PLI scheme, tax relief | 22-28 | 63 |

| China | 650 | Export tax rebates, subsidies | 18-25 | 31 |

| Vietnam | 310 | Corporate tax breaks | 25-35 | 70 |

| Mexico | 400 | Free trade zones | 5-12 (US) | 60 |

Most folks focus only on electronics manufacturing costs, but as you can see, the real decision goes way deeper. Think long-term. Consider growth potential, talent pipeline, and the headaches you might face if things go sideways. Sure, India is looking better than ever right now, especially if you need to scale quickly or want policy backup. Just don’t forget to double-check supply chain links and local stability before signing anything.