China Electronics: Trends, Production and Market Impact

When talking about China electronics, the massive network of design, component fabrication, and product assembly that powers everything from smartphones to industrial controllers in the People’s Republic of China. Also known as Chinese electronics industry, it fuels both local tech growth and global product pipelines.

One of the biggest China electronics sub‑segments is consumer electronics, everyday gadgets like smartphones, laptops, wearables and home appliances that end up on retail shelves worldwide. This area accounts for over half of the country’s electronic output and directly feeds the global demand for affordable tech.

The backbone of that output is the semiconductor industry, the design and wafer‑fabrication ecosystem that creates chips for phones, cars, AI devices and more. Advances in chip manufacturing enable higher‑performance consumer devices and keep China at the forefront of tech innovation.

These three entities create a clear semantic chain: China electronics encompasses consumer electronics, consumer electronics relies on the semiconductor industry, and the semiconductor industry drives the global supply chain. In other words, the health of China’s electronics ecosystem directly influences worldwide product availability and price trends.

Key forces shaping the sector

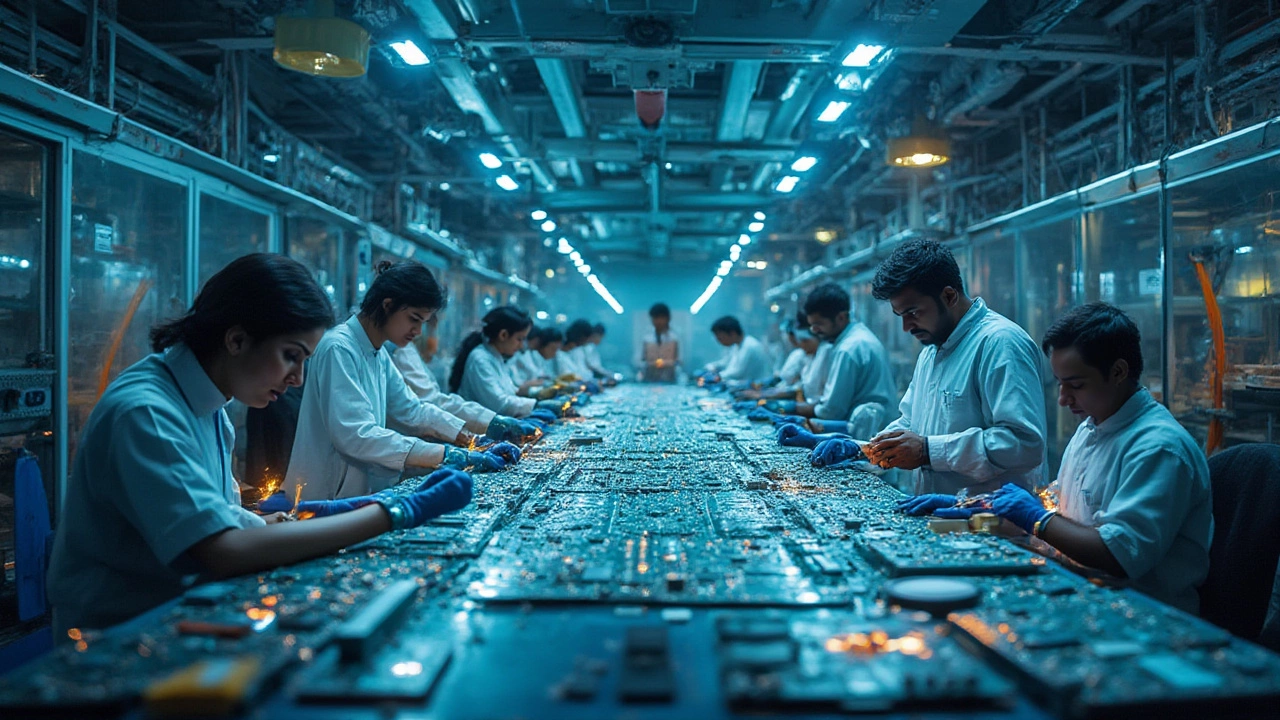

First, government policy plays a huge role. Initiatives like “Made in China 2025” push for local component sourcing, reducing reliance on foreign chips and encouraging R&D investment. Second, cost efficiency remains a core advantage. Skilled labor, scale economies, and mature logistics keep production margins tight, attracting multinational brands to set up assembly lines.

Third, technology upgrades matter. Automation, AI‑driven quality control, and smart factories are reshaping factories from labor‑intensive shops to data‑rich production hubs. These upgrades increase yield, cut defects, and speed time‑to‑market.

Fourth, export dynamics matter. Over 60% of China’s electronic goods leave the country each year, feeding markets in the US, Europe, and Southeast Asia. Trade policies, tariffs, and geopolitical shifts can instantly swing shipment volumes.

Fifth, sustainability pressures are rising. Companies are now forced to adopt greener materials, improve waste recycling, and lower carbon footprints to meet international standards and consumer expectations.

Because of these forces, the market is constantly evolving. For instance, the rise of 5G and IoT devices has spurred demand for high‑frequency components, prompting local fabs to expand capacity. Similarly, the surge in electric vehicles creates a new wave of power‑module and battery‑management chip production.

If you’re a supplier, investor, or tech enthusiast, understanding how these pieces fit together helps you spot growth pockets—whether it’s a niche component supplier, a contract manufacturer upgrading to Industry 4.0, or a service firm enabling supply‑chain visibility.

Below, you’ll find a curated set of articles that dive deeper into specific aspects of this ecosystem. From heavy‑equipment market shares that indirectly affect component demand, to the latest high‑demand product forecasts for 2025, each piece adds a layer of insight. Browse the collection to see how broader industry trends intersect with the China electronics landscape and to gather actionable ideas for your next move.