You use a smartphone daily. Maybe two screens, a laptop, some wireless earbuds, and a smartwatch in the mix. But have you ever paused mid-scroll and thought, "Who’s really making all this stuff?" The answer may not be as simple as you’d expect. The race for electronics manufacturing supremacy isn’t just about cheap labor or clever engineers. It’s about scale, logistics, patents, talent, and even politics. Let’s unpack the real story of who’s leading the electronics world in 2025—and why it matters.

The Rise of Asia: Why China Holds the Top Spot

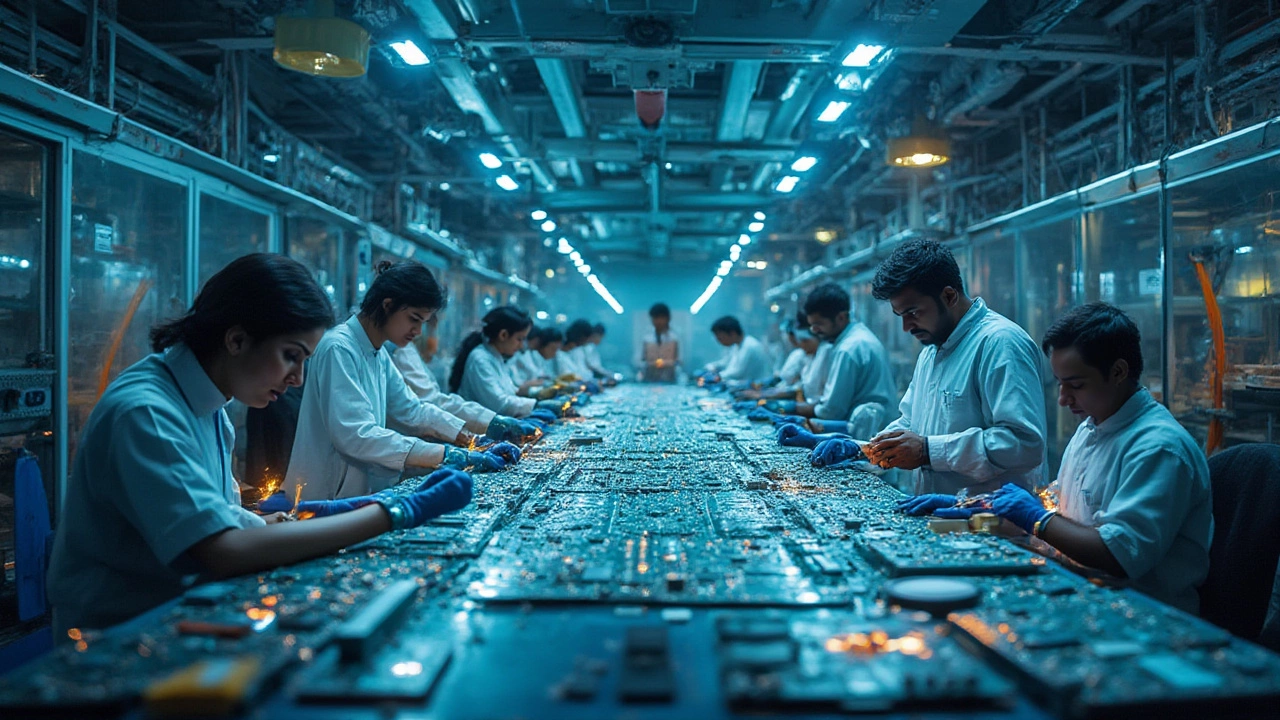

China’s dominance in electronics manufacturing is nothing short of legendary. If you flipped over almost any gadget in the last decade, odds are good you’d see a small inscription: “Made in China.” It’s not just branding—it’s a sign of relentless growth and an unmatched manufacturing ecosystem. Foxconn, the company that assembles iPhones, employs over one million workers in China. Shenzhen, once a small fishing village, is now called the "Silicon Valley of Hardware," filled with factories that crank out smartphones, routers, game consoles, and chips so rapidly it’s hard to keep count.

What makes China run the show? First, sheer scale. No other country can marshal the workforce numbers, supply chain agility, and giant infrastructure projects China pulls together. Trains zip parts across industrial provinces, seaside ports move containers to waiting ships in hours, and skilled workers operate machinery around the clock. Tech giants like Apple, Huawei, Xiaomi, and Lenovo rely on this web. Add in cheaper labor (though rising steadily), huge local demand, and government support, and you have a perfect storm. Beijing’s policies and subsidies help local firms climb up the value chain, from basic assembly to cutting-edge chip design.

Here’s a striking fact: In 2023, China produced more than 35% of the world’s electronics exports. That includes not just consumer goods—think washing machines, TVs, laptops—but also the circuit boards, batteries, and sensors powering future innovations in AI, EVs, even satellites. And despite rising wages and trade tensions, no rival has toppled China from this throne yet. Sure, other Asian nations are nipping at its heels, but when it comes to scale, integration, and raw production power, China’s grip remains firm in 2025.

Challengers on the Horizon: South Korea, Taiwan, and Vietnam

While China sits on top, neighbors in East and Southeast Asia are making serious moves. Let’s talk about South Korea, the land of Samsung and LG. These are not just electronics giants; they’re innovation powerhouses. Samsung commands almost a quarter of the global memory chip market. South Korean firms create flagship smartphones, OLED displays, and even advanced chipsets used in cars and data centers around the world. With government-driven R&D investment (over 4.8% of its GDP), South Korea keeps pushing tech boundaries. Government policies there reward export-focused electronics innovation and support high-level tech manufacturing with talent pipelines and generous grants.

Taiwan is another player you just can’t ignore. It’s the home base for TSMC (Taiwan Semiconductor Manufacturing Company), the world’s go-to chipmaker. Apple, AMD, Nvidia, even Tesla—if a company needs state-of-the-art microchips, it turns to TSMC. Taiwan’s precision and reliability are legendary. About 92% of advanced semiconductors in devices today originate from its factories, according to a 2024 industry report. And with exclusive, tightly guarded know-how, TSMC keeps global tech humming along, even as geopolitical tensions with China create a precarious edge for supply chains.

Vietnam has quietly surged as the go-to alternative for global brands looking beyond China. Why? Wages are lower, factories are modern, and the government is business-friendly. In five years, Vietnam attracted billions in foreign investment, especially from companies diversifying supply chains. Samsung has made Vietnam its largest smartphone production base. Dell and Apple source more parts here every year. Vietnamese exports of phones, computers, and components soared past $110 billion in 2024. Engineers are trained quickly, while logistics hubs near Ho Chi Minh City keep products flying out the door. It’s like a mini-Shenzhen, and momentum is building.

The Role of the United States and Europe: Tech Titans vs. Manufacturing Muscle

Let’s get one thing straight: Silicon Valley sets a ton of tech’s global trends, but when it comes to actually making stuff, the U.S. doesn’t dominate as it once did. American firms—think Apple, Intel, Texas Instruments—design chips, software, and products that shape the world. But nearly all physical assembly happens overseas. The big reason? Labor costs, environmental regulations, and, well, decades of supply chain shifting abroad.

The U.S. does have a few manufacturing bright spots. Intel and Micron build the world’s most advanced logic and memory chips on home turf. The Chips and Science Act kicked things up a notch, with over $50 billion in federal investment designed to revive critical semiconductor manufacturing at home. New fabs (that’s chip-speak for factories) are rising in Arizona, New York, and Texas. If this keeps up, some analysts believe the U.S. could double its share of global chip production by 2030. But this is a long game, and right now, the States mostly engineers and innovates, while Asia gets stuff built.

Europe plays a different game. German factories are best-in-class for automotive electronics—think Bosch and Siemens supplying parts for BMWs and Mercedes. Infineon, ASML, STMicroelectronics, and NXP handle specialty chips, embedded sensors, and critical supplies for everything from cars to medical gear. The European Union is also pouring billions into “sovereign chips” funding. But volume manufacturing? The continent lags Asia by a wide margin. It’s more about precision, quality, and supporting high-value sectors than turning out zillions of gadgets. If you love reliability and long-life tech, European makers still shine.

Supply Chains, Geopolitics, and the Battle for the Future

Here’s a reality: Electronics isn’t just about who makes your phone, but which country controls your access when the world gets messy. COVID-19 exposed huge vulnerabilities—suddenly, companies everywhere realized how tightly knotted their supply chains were across China, Taiwan, and Southeast Asia. Politicians and executives now obsess over resilience. Japan, for example, pioneered “just in time” manufacturing but now invests in “just in case” strategies with expanded chip stockpiles and redundant suppliers.

Geopolitical chess only intensifies things. The U.S. and China exchange tech bans and tariffs; Taiwan feels the heat of jittery neighbors; the EU wants “technological sovereignty.” This isn’t bad news for consumers wanting the latest smartwatch, but for companies, it means constant adaptation. Some brands, like Apple, now juggle factories in China, India, and Vietnam to sidestep trade friction. Governments add sweeteners for domestic production—ubiquitous news stories about multibillion-dollar chip plants in Arizona or Dresden aren’t just PR—they’re a scramble for security and jobs.

It’s also about raw resources. Electronics need rare earths, silicon, copper, and many more ingredients. China controls over 60% of rare earth refining. That’s huge leverage. Meanwhile, Japan, South Korea, and the U.S. race to ink deals, fund green mining, or recycle precious metals from old phones. Basically, the future belongs to whoever can keep their production running, even when things get rough.

What the Future Holds: Innovation, Automation, and the Next Electronics Leader

Will China stay on top? Probably, but it won’t be easy. Rising wages push companies to automate or move production. China’s government is betting big on robotics and smart factories to keep pace—for example, Foxconn now operates 100,000 robot arms and growing. The Chinese push for homegrown chips is real; they’re determined to close any technology gaps. But relentless competitors are chasing hard. India, for instance, wants its share. By 2025, it’s already assembling millions of smartphones, drawing on a vast labor force and government “Make in India” incentives.

Vietnam is the region’s rising star. Its talent pool is expanding, and multinational brands keep moving factories there. If costs rise, the electronics world might see new contenders: maybe Indonesia, even Mexico as "nearshoring" grows. Sustainability, too, is a giant wildcard. Consumers want eco-friendly gadgets, forcing companies to build greener factories, recycle more, and cut waste—whoever cracks this code could lead the next era.

One thing’s clear: Countries that try to do it all alone will struggle. Collaboration and innovation will separate the real leaders from the rest. Whether it’s mega-rendering chips, virtual reality headsets, quantum processors, or plain old smartphones, the industry keeps moving fast. Electronics manufacturing isn’t just about who makes the most—it’s about who can adapt, scale, and invent for tomorrow. Stay tuned. The leaderboard might just surprise you next year.