India electronics export: Trends, Challenges, and Growth Opportunities

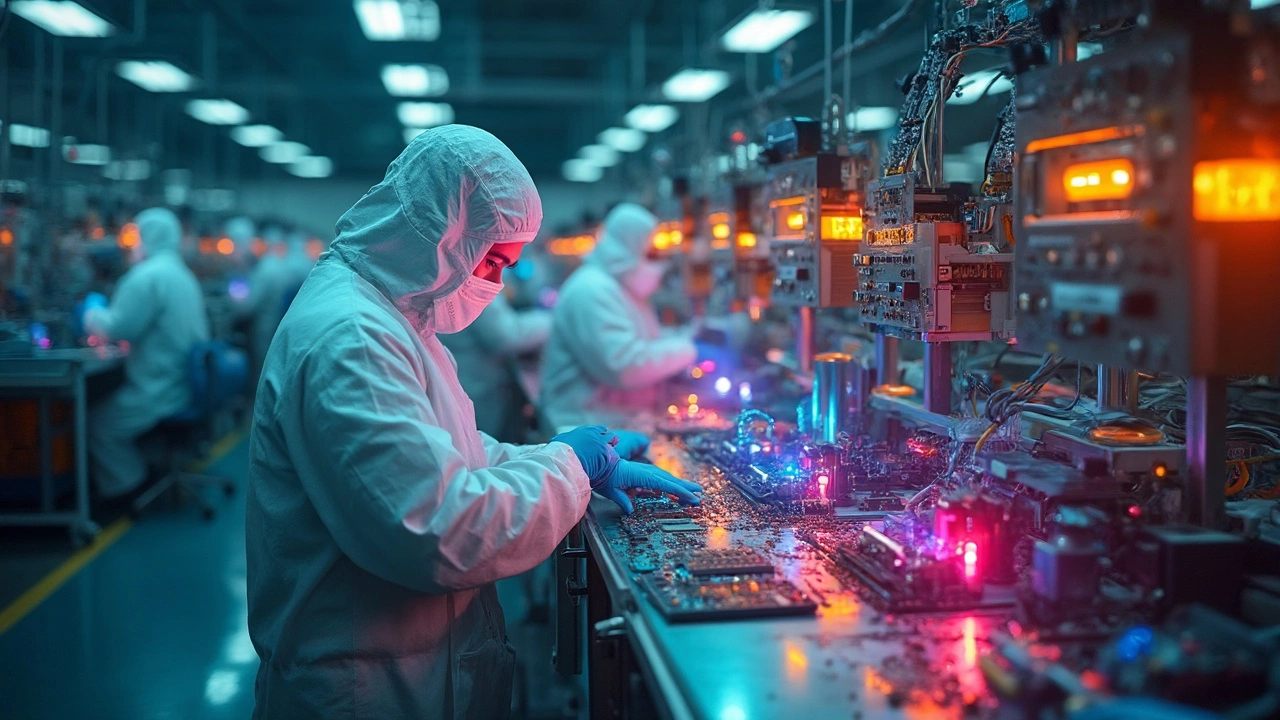

When working with India electronics export, the flow of electronic goods from India to global markets. Also known as Indian electronics trade, it reflects the country’s manufacturing push and policy support.

One of the biggest forces behind this trade is AI chips, specialized processors for artificial‑intelligence workloads. Domestic firms like Saankhya and Startups in Bengaluru are moving from design to volume production, turning a previously import‑heavy segment into a potential export hero. In FY2024, AI‑related hardware contributed roughly $1.2 billion to overall electronics shipments, showing how niche tech can lift the whole export basket.

But AI chips don’t exist in a vacuum. They need a robust semiconductor manufacturing, the end‑to‑end process of fabricating chips, from wafer fab to packaging ecosystem. India’s new “fab‑first” policy has attracted $7 billion of foreign direct investment, leading to three operational fabs by 2025. These fabs drive higher yields, lower per‑unit cost, and ultimately make exports more competitive against China, Taiwan, and South Korea.

A strong export policy, government rules that govern how electronic products leave the country ties the two together. Incentives such as duty remission on raw material imports, and the Production‑Linked Incentive (PLI) scheme, have lifted electronics export growth to an average 12% YoY since 2021. The policy also streamlines customs clearance, cutting lead times by 15 days for high‑value items like smartphones and medical devices.

Key drivers of India’s electronics export growth

First, rising global demand for affordable, high‑quality electronics is reshaping supply chains. Brands looking to diversify away from traditional hubs are tapping Indian factories that can meet both cost and quality benchmarks. Second, the skilled labor pool—over 1.2 million engineers graduating yearly—feeds R&D pipelines and keeps production agile. Third, government‑backed initiatives in skill development ensure factories can adopt advanced automation without a talent shortage.

Data from the Ministry of Commerce shows that total electronics exports hit $12.5 billion in FY2024, up from $11.0 billion two years earlier. Smartphones, consumer electronics, and automotive electronics together accounted for 68% of that value, while high‑margin items like AI chips and defense‑grade components grew at 25% annual rates. These numbers prove that diversification across product categories reduces risk and boosts overall export resilience.

Supply‑chain reliability also matters. Recent disruptions in East‑Asia highlighted the advantage of a geographically dispersed network. India’s ports, especially Kandla and Chennai, have expanded container handling capacity by 30% since 2022, cutting dwell time and improving on‑time delivery for export orders. Companies that align their logistics strategy with these port upgrades report a 10% reduction in export‑related costs.

Innovation ecosystems are another catalyst. The government’s “Electronics Manufacturing Clusters” bring together academia, startups, and multinational corporations. Cluster participants have filed over 1,800 patents in the last three years, many targeting low‑power, high‑efficiency designs that appeal to export markets focused on sustainability. When a product meets both performance and environmental standards, it gains easier access to EU and US markets.

Competitive pricing is no longer the only lever. Quality certifications—such as ISO 9001 and IEC 62443—have become prerequisites for many overseas contracts. Indian exporters that invest early in these certifications see an average order size increase of 18%, according to a 2023 industry survey. This shows that compliance can be a profit driver, not just a compliance cost.

Looking ahead, the next wave will likely involve 5G infrastructure equipment and Internet‑of‑Things (IoT) modules. Forecasts from NASSCOM predict a 22% CAGR for Indian IoT exports through 2027, driven by smart‑city projects abroad. Companies that position themselves now—by scaling pilot production lines and securing early partnerships—stand to capture a sizable slice of that growth.

While the outlook is bright, challenges remain. Currency volatility can erode margins, and trade‑policy shifts in partner countries may introduce new tariffs. To mitigate these risks, firms are adopting hedging strategies and diversifying their market mix between North America, Europe, and emerging economies in Africa and Southeast Asia.

In short, India’s electronics export story is a blend of policy support, manufacturing capability, and market demand. The synergy of AI chips, semiconductor fabs, and an export‑friendly framework creates a virtuous cycle that lifts the entire sector.

Below you’ll find a curated collection of articles that dig deeper into each of these aspects—market trends, policy analysis, technology breakthroughs, and practical guidance for anyone looking to tap into India’s booming electronics export arena.